3rd Quarter Market Update

Even if you aren’t in the market to buy or sell your home right now, it is hard to avoid the very loud chatter from media, friends, and neighbors about the changing real estate market in the US and, more importantly, in your backyard.

If you have been paying attention, chances are you are a little worried about the state of the real estate market. We understand your trepidation, but we also want to give you real market data to help you understand what is happening.

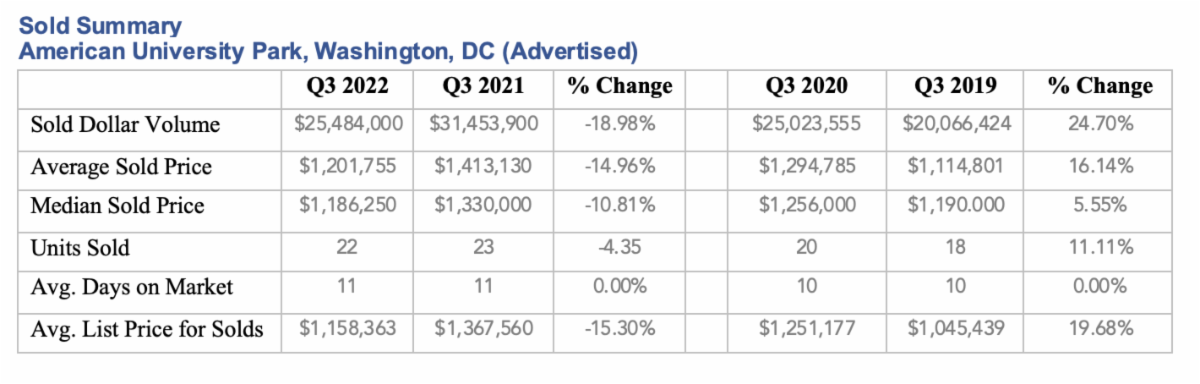

This graph is a snapshot of the last four years in American University Park, DC. Like many other neighborhoods in the region in 2019, AU Park had been enjoying a long and healthy market. When Covid hit in 2020, the market activity and prices jumped to almost unbelievable heights. This frenetic level of activity continued through 2021 and the first half of 2022. Then, almost as dramatically, the market changed when interest rates increased, and consumer confidence fell. You can see from the most recent numbers for 2022 that sales and prices fell back to 2019, pre-Covid levels.

SELLERS: In response to the new market environment, our sellers are realizing that they need to adjust their price expectations and probably the length of time their property will remain on the market. But it is a slow process for some sellers, who have watched home prices run up at double-digit rates for the past two years. They may not be happy about it, but this is the reality for sellers.

The good news is home prices are still way up year over year! Experts estimate that home values have increased over 22% since 2020 in the DMV. What other investment can match that return? The DC area enjoys an amazingly strong and resilient real estate market during all sorts of economic times.

BUYERS: Buyers are pulling back in the face of rising mortgage rates and economic uncertainty. On top of that, most current homeowners have probably refinanced in the past couple of years and are sitting comfortably with their very low interest-rate mortgages. They aren’t super motivated to enter into a new, long-term loan with an interest rate that could be double their existing rate.

Despite this recent shift, we actually think it’s a really good time to buy! The higher interest rates have created a much less crowded and competitive buying environment. Housing prices have decreased, and buyers can once again include contingencies in an offer. Additionally, there are lots of creative lending options available right now. The 7-year arm has come back with a vengeance. This loan product will allow home buyers several years of a lower interest rate. Let us know if you would like to talk with a lender about your options; we work with some very smart and creative lenders who can find the right loan product for you.

In summary, we think it will take some time for the market and mindsets to settle into the “new normal.” As always, people get on with their lives, they transfer to new cities for job opportunities, they upsize and downsize, and they experience a multitude of happy and sad life events that cause people to transact in the real estate market. If you are a buyer or seller in today’s market, it is more important than ever to partner with a knowledgeable, competent, and focused real estate agent who is intimately familiar with the market conditions.

On behalf of our entire team, we wish you and your family a wonderful Thanksgiving.

PS: We recently took a pre-Thanksgiving trip to Spain. It was amazing and allowed us to reflect on how much we have to be thankful for with our family and our clients like you.

Anne-Marie Finnell & Kelly Lee